|

Unlocking Homebuyer Opportunities in 2024

There’s no arguing this past year has been difficult for homebuyers. And if you’re someone who has started the process of searching for a home, maybe you put your search on hold because the challenges in today’s market felt like too much to tackle. You’re not alone in that. A Bright MLS study found some of the top reasons buyers paused their search in late 2023 and early 2024 were:

1. The Supply of Homes for Sale Is Growing One of the most significant shifts in the market this year is how the months’ supply of homes for sale has increased. If you look at data from the National Association of Realtors (NAR), you’ll see how inventory has grown throughout 2024 (see graph above): This graph shows the months’ supply of existing homes – homes that were previously lived in by another homeowner. The upward trend this year is clear. This increase means you have a better chance of finding a home that suits your needs and preferences. And if the biggest reason you put off your home search was difficulty finding the right home, this is a big relief. 2. There’s More New Home Construction And if you still don’t see an existing home you like, another big opportunity lies in the rise of new home construction. Builders have worked to increase the supply of newly built homes this year. And they’ve turned their attention to crafting smaller, more affordable homes based on what’s most needed in today’s market. This helps address the long-standing issue of housing undersupply throughout the country, and those smaller homes also offset some of the affordability challenges you’re feeling today. According to data from the Census and NAR, one in three homes on the market is a newly built home. This means, that if you didn’t previously look at newly built homes as part of your search, you may have been cutting your pool of options by a third. Not to mention, some builders are also offering incentives like buying down mortgage rates to make it easier for buyers to get a home that fits their budget. So, consider talking to your agent about what builders have to offer in your area. Your agent’s expertise on builder reputations, contracts, and more will help you weigh your options. 3. Less Buyer Competition Mortgage rates are still hovering around 7%, so buyer demand isn’t as fierce as it once was. And when you combine that with more housing supply, you have a better chance of avoiding an intense bidding war. Danielle Hale, Chief Economist at Realtor.com, highlights the positive trend for the latter half of 2024, saying: “Home shoppers who persist could see better conditions in the second half of the year, which tends to be somewhat less competitive seasonally, and might be even more so since inventory is likely to reach five-year highs.”This creates a unique opportunity for you to find a home you want to buy with less stress and at a potentially better price. 4. Home Prices Are Moderating Speaking of prices, home prices are also showing signs of moderation – and that’s a welcome shift after the rapid appreciation seen in recent years (see graph below): This moderation is mostly due to supply and demand. Supply is growing and demand is easing, so prices aren’t rising as fast. But make no mistake, that doesn’t mean prices are falling – they’re just rising at a more normal pace. You can see this in the graph. The bars are still showing prices increasing, just not as dramatic as it was before. The average forecast for home price appreciation in 2024 is for positive growth around 3% to 5%, which is more in line with historical norms. That moderation means that you are less likely to face the steep price increases we saw a few years ago. The Opportunity in Front of YouIf you’re ready and able to buy, you may find that the second half of 2024 is a bit easier to navigate. There are still challenges, but some of the biggest hurdles you’ve faced are getting better as time wears on. On the other hand, you could choose to wait. But if you do, here’s the risk you run. As more buyers recognize the shift in the market, competition will grow again. On a similar note, if mortgage rates do come down (as forecasts say), more buyers will flood back into the market. So, making a move now helps you take advantage of the current market conditions and get ahead of those other buyers. Bottom Line If you’ve put your dream of homeownership on hold, the second half of 2024 may be your chance to jump back in. Let’s connect to talk more about the opportunities you have in today’s market.

0 Comments

Lobolighting Black Round Decorative Serving Tray, Black Decorative Tray for Coffee Table Centerpieces Modern Farmhouse Home Decorations. www.amazon.com/Lobolighting-Decorative-Centerpieces-Farmhouse-Decorations/dp/B09S3QBTRZ/ref=asc_df_B09S3QBTRZ/?tag=hyprod-20&linkCode=df0&hvadid=589692395656&hvpos=&hvnetw=g&hvrand=11063734306532065545&hvpone=&hvptwo=&hvqmt=&hvdev=c&hvdvcmdl=&hvlocint=&hvlocphy=9021463&hvtargid=pla-1657059743519&th=1

Selling your home when you still need to shop for a new one can feel daunting to even the most seasoned homeowner––especially when the demand for new homes keeps rising, but the supply feels like it's dwindling. You're not alone either if you're already feeling drained by the complex logistics of trying to sell and buy a new home all at once.

Searching for a new home can be exciting, but many homebuyers admit that it can also be stressful, especially if you live in an unpredictable market with plenty of competitors. Unfortunately, waiting out a competitive housing market isn’t always the best idea either since homes are in notoriously short supply and listings are expected to remain limited in the most coveted neighborhoods for some time. That doesn't mean, though, that you should just throw up your hands and give up on moving altogether. In fact, as a current homeowner, you could be in a better position than most to capitalize on a seller’s market and make a smooth transition from your old home to a new one. We can help you prepare for the road ahead and answer any questions you have about the real estate market. For example, here are some of the most frequent concerns we hear from clients who are trying to buy and sell at the same time. “WHAT WILL I DO IF I SELL MY HOUSE BEFORE I CAN BUY A NEW ONE?” This is an understandable concern for many sellers since the competitive real estate market makes it tough to plan ahead and predict when you'll be able to move into your next home. But chances are, you will still have plenty of options if you do sell your home quickly. It may just take some creativity and compromise. Here are some ideas to make sure you're in the best possible position when you decide to list your home: Tip #1: Flex your muscles as a seller. In a competitive market, buyers may be willing to make significant concessions in order to get the home they want. In some cases, a buyer may agree to a sell and lease back agreement (also known as a "sell house and rent back" option) that allows the seller to continue living in the home after closing for a set period of time and negotiated fee. This can be a great option for sellers who need to tap into their home equity for a down payment or who aren’t logistically ready to move into their next home. If you're dealing with an investor rather than a traditional buyer, you may even be able to negotiate a lengthy lease and lower rent payment than your current mortgage.³ However, leaseback agreements can be complex, with important legal, financial and tax issues to consider.⁴ At minimum, a carefully-worded contract and security deposit should be in place in case of any property damage or unexpected repairs that may be needed during the leaseback period. Tip #2: Open your mind to short-term housing options. While it can be a hassle to move out of your old home before you’re ready to move into your new one, it’s a common scenario. If you’re lucky enough to have family or generous friends who offer to take you in, that may be ideal. If not, you’ll need to find temporary housing. Check out furnished apartments, vacation rentals and month-to-month leases. If space is an issue, consider putting some of your furniture and possessions in storage. You may even find that a short-term rental arrangement can offer you an opportunity to get to know your new neighborhood better—and lead to a more informed decision about your upcoming purchase. Tip #3: Embrace the idea of selling now and buying later. Instead of stressing about timing your home sale and purchase perfectly, consider making a plan to focus on one at a time. Selling before you’re ready to buy your next home can offer a lot of advantages. For one, you’ll have cash on hand from the sale of your current home. This will put you in a much better position when it comes to buying your next home. From budgeting to mortgage approval to submitting a competitive offer, cash is king. And by focusing on one step at a time, you can alleviate some of the pressure and uncertainty. “WHAT IF I GET STUCK WITH TWO MORTGAGES AT THE SAME TIME?” This is one of the most common concerns that we hear from buyers who are selling a home while shopping for a new one, and it’s realistic to expect at least some overlap in mortgage payments. Assuming you can secure financing, however, it's still a good idea to examine your budget and calculate the maximum number of months you can afford to pay two mortgages before you jump on a new home. Potential stopgap solutions, such as bridge financing, can also help tide you over if you qualify. If you simply can’t afford to carry both mortgages for any amount of time, or if you are concerned about passing the mortgage stress test, then selling before you buy may be your best option. (See Tip #3 above.) But if you have some flexibility in your budget, it is possible to manage both a home sale and purchase simultaneously. Here are some steps you can take to help streamline the process: Tip #4: As you get ready to sell, simplify. You can condense your sales timeline if you only focus on the home renovations and tasks that matter most for selling your home quickly. For example, clean and declutter all of your common areas, refresh your outdoor paint and curb appeal and fix any outstanding maintenance issues as quickly as possible. But don't drain unnecessary time and money into pricey renovations and major home projects that could quickly bog you down for an unpredictable amount of time. We can advise you on the repairs and upgrades that are worth your time and investment. Tip #5: Prep your paperwork. You'll also save valuable time by filing as much paperwork as possible early in the process. For example, if you know you'll need a mortgage to buy your next home, get pre-approved right away so that you can shorten the amount of time it takes to process your loan.⁶ Similarly, set your home sale up for a fast and smooth transition by pulling together any relevant documentation about your current home, including appliance warranties, renovation permits, and repair records. That way, you're ready to provide quick answers to buyers' questions should they arise. Tip #6: Ask us about other conditions that can be included in your contracts. Part of our job as agents is to negotiate on your behalf and help you win favorable terms. For example, it’s possible to add a contract condition known as a "subject to sale" or "sale of property" (SOP) condition to your purchase offer that lets you cancel the contract if you haven't sold your previous home.⁷ This tactic could backfire, though, if you're competing with other buyers. We can discuss the pros and cons of these types of tactics and what’s realistic given the current market dynamics. “WHAT IF I MESS UP MY TIMING OR BURN OUT FROM ALL THE STRESS?” When you're in the pressure cooker of a home sale or have been shopping for a home for a while in a competitive market, it's easy to get carried away by stress and emotions. To make sure you're in the right headspace for your homebuying and selling journey, take the time to slow down, breathe and delegate as much as possible. In addition: Tip #7: Relax and accept that compromise is inevitable. Rather than worry about getting every detail right with your housing search and home sale, trust that things will work out eventually––even if it doesn't look like your Plan A or even your Plan B or Plan C. Perfecting every detail with your home decor or timing your home sale perfectly isn't necessary for a successful home sale and compromise will almost always be necessary. Luckily, if you've got a good team of professionals, you can relax knowing that others have your back and are monitoring the details behind the scenes. Tip #8: Don't worry too much if your path is straying from convention. Remember that rules-of-thumb and home-buying trends are just that: they are estimates, not facts. So if your home search or sale isn't going exactly like your neighbors' experience, it doesn't mean that you are doomed to fail. It's possible, for example, that seasonality trends may affect sales in your neighborhood. So a delayed sale in the summer or fall could affect your journey––but not necessarily. According to National Association of REALTORS. The housing market used to be more competitive during the fall and spring and less competitive during the winter. But it's not a hard and fast rule, and real estate markets across the US have seen major shifts in recent years. Every real estate transaction is different. That's why it's important to talk to a local agent about your specific situation. Tip #9: Enlist help early. If possible, call us early in the process. We'll not only provide you with key guidance on what you should do ahead of time to prepare your current home for sale, we'll also help you narrow down your list of must-haves and wants for your next one. That way, you'll be prepared to act quickly and confidently when you spot a great house and are ready to make an offer. It's our job to guide you and advocate on your behalf. So don't be afraid to lean on us throughout the process. We’re here to ease your burden and make your move as seamless and stress-free as possible. BOTTOMLINE: COLLABORATE WITH A REAL ESTATE PROFESSIONAL TO GET TAILORED ADVICE THAT WORKS FOR YOU Buying and selling a home at the same time is challenging. But it doesn't have to be a nightmare, and it can even be fun. The key is to educate yourself about the market and prepare yourself for multiple scenarios. One of the best and easiest ways to do so is to partner with a knowledgeable and trustworthy agent. A good agent will not only help you evaluate your situation, we will also provide you with honest and individually tailored advice that addresses your unique needs and challenges. Depending on your circumstances, now may be a great time to sell your home and buy a new one. But a thorough assessment may instead show you that you're better off pausing your search for a while longer. Contact us for a free consultation so that we can help you review your options and decide the best way forward. Unless you’ve been living under a rock, you’ve probably heard about the seller’s market currently taking place around the globe. Seeing what homes are selling for in your neighborhood may have you wondering, “should I sell my home, too?” In this post, we’ll go over the top signs that it may be time for you to get your very own “For Sale” sign. #1. Your Home Is No Longer Meeting Your Needs. Outgrowing your home is very common — especially for first-time buyers who outgrow their “starter homes.” As your family grows, it makes sense that a house you bought just for your partner and you starts to feel a little too snug for comfort. Once your family starts growing, or your needs change, there’s a good chance you’ll want to sell and find a new home. Of course, you should have a plan in place before listing your home as far as when the right time to list is (don’t forget to take school, work, and extracurricular schedules into account). Here are some other things to think about:

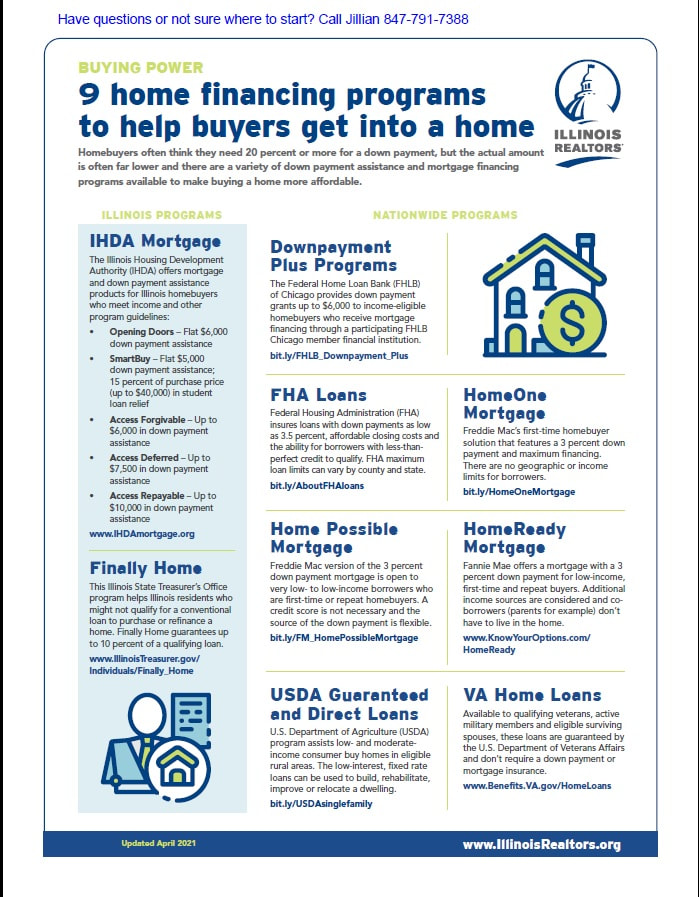

#2. Your Home’s Upkeep Is Taking a Toll. If your to-do list is never-ending and unexpected repairs pop up by the day, it might be time for a house that requires less maintenance and upkeep. Did you know the average homeowner pays $2,000 per year to maintain their home? That includes landscaping, snow removal, trash and recycling, gardening, house cleaning, septic services, and so on. That doesn’t even cover what it costs to make repairs. These costs on top of property tax and the mortgage can start to add up — surprising some first-time homeowners in particular. If it’s becoming too hard to afford upkeep or tackle the list of DIY repairs and home chores, downsizing might be in your near future — especially if your home needs excessive upkeep and maintenance and it’s no longer worth it. #3. It Makes Financial Sense To Sell A house is the most significant investment we make, and homes can accrue a lot of value as the years pass by. If you’ve owned your house for a long time and your mortgage is paid or almost paid off, you have excellent built-in equity, and given today’s market, this may be the perfect time for you to recoup a large portion of your nest egg. The housing market is expected to stay red hot in 2022 as home values will increase by an additional 11% in 2022 after increasing by a record 13% in 2021. So, if you're wondering when a good time to sell is, now is your answer! Additionally, if your financial situation has changed — either way — it might be time for a new home to accommodate your new lifestyle. A recent promotion might allow you to finally get that home with a swimming pool, while a job loss may require you to move into a smaller home. #4. You’ve Done Your Research The best seller is a well-informed seller. If you’ve done your research on both the national and local market and know that it’s a good time to sell a home, you’re one step ahead of the game. Researching Realtors during this time is also an excellent idea because you can chat with them about what houses are selling for and get the inside scoop if any of your neighbors with homes similar to yours are planning to list theirs soon so you can know what you may be competing with — and make the required repairs/upgrades to outshine them! #5. You Know What’s Next The thing about selling your home is, you’ll no longer have a home. You certainly don’t want to put yourself and your family out on the street! So, before you decide to list your home, you need to have a pretty good idea of what the next steps are for your living situation. Will you be relocating? Downsizing? Moving to a different school district? Whatever reason you’re moving for, it’s important to start devising a plan, researching your intended market, and figuring out what you’ll do when your current home sells. First Time Home Buyers in Lake County may qualify for these local Illinois programs. #howtobuyahome #Mundeleinrealestate #realtor #lakecountyrealestate #firsttimehomebuyer #soldwithjillian #buyahome2021 #century21affiliated

Homeownership Is Full of Financial Benefits

A Fannie Mae survey recently revealed some of the most highly-rated benefits of homeownership, which continue to be key drivers in today’s power-packed housing market. Here are the top four financial benefits of owning a home according to consumer respondents:

Does homeownership actually give you a better chance to build wealth?No one can question a person’s unique feelings about the importance of homeownership. However, it’s fair to ask if the numbers justify homeownership as a financial asset. Last fall, the Federal Reserve released the Survey of Consumer Finances, a report done every three years, with the latest edition covering through 2019. Their findings confirmed that homeownership is a clear financial benefit. The survey found that homeowners have forty times higher net worth than renters ($255,000 for homeowners compared to $6,300 for renters). The difference in net worth between homeowners and renters has continued to grow. Here’s a graph showing the results of the last four Fed surveys:The above graph only includes data through 2019, but according to CoreLogic, the equity held by homeowners grew by $26,300 over the last twelve months alone. That means the gap between the net worth of homeowners and renters has probably widened even further over the last year. Some might argue the difference in net worth may be due to homeowners normally having larger incomes than renters and therefore the ability to save more money. However, a study by First American shows homeowners have greater net worth than renters regardless of their income level. Here are the findings: Others may think homeowners are older and that’s why they have a greater net worth. However, a Joint Center for Housing Studies of Harvard University report on homeowners and renters over the age of 65 reveals: “The ability to build equity puts homeowners far ahead of renters in terms of household wealth…the median owner age 65 and over had home equity of $143,500 and net wealth of $319,200. By comparison, the net wealth of the same-age renter was just $6,700.” Homeowners 65 and older have 47.6 times greater net worth than renters. Bottom LineThe idea of homeownership as a direct way to build your net worth has met the test of time. Let’s connect if you’re ready to take steps toward becoming a homeowner. I think we all can agree that our "once-a-year spring cleaning ritual" has happened more than once or twice, maybe even ten times in the last few months. Believe us, we are with you 100%. This downtime has also helped us discover that we are neglecting certain home appliances each year that need more than just a cosmetic cleaning! The easiest kitchen appliance that needs a little more TLC internally is a dishwasher! Weird right? A sturdy and mighty little appliance that has one job, and one job only: to disinfect our daily cookware that is crawling with germs, bacteria, and last night's dinner! What about the grease or food particles that were not rinsed properly before placing in the dishwasher? Where does it go? The answer is nowhere. It slowly starts to build up inside of the dishwasher; coating the blades, the walls, and the bottom coils. But don't you worry! There is no need to start googling expensive cleaning products and time consuming processes. This is where the household staple and DIY superhero white vinegar comes to save the day! Below is a super easy and simple solution for a maintenance-free dishwasher:

Optional extra step: Sprinkle a handful of baking soda into the bottom of your dishwasher. Run it through another wash cycle using the hottest water setting. |

Jillian Webb Archives

August 2023

|

RSS Feed

RSS Feed